Greatest Defi Yield Farming Platforms In 2025: Explore The Highest Defi Yield Farming Platforms For Max Returns!

It Is also important to do not forget that these are just estimates and projections. Even short-term rewards are troublesome to estimate accurately as a result of yield farming is highly competitive and fast-paced, and rewards can fluctuate quickly. If a yield farming technique https://www.xcritical.com/ works for a while, many farmers will jump on the chance, and it may no longer yield high returns.

- This will help the users make a greater decision when it comes to where to put their tokens.

- Yield farming has traditionally been crypto-native, relying on DeFi tokens and stablecoins.

- Issuing native tokens specific to the yield farming platform supplies a multifaceted monetization strategy.

If you’ve ever wished your crypto might work for you, DeFi yield farming is strictly that. Yield farming is a key a part of decentralized finance (DeFi), allowing customers to earn rewards by providing liquidity, lending property, or staking tokens. It’s like placing your cash into a high-yield savings account, however instead of a bank, you’re trusting a decentralized protocol powered by smart contracts.

It Is important to do your individual analysis and contemplate components such as platform security, neighborhood support, and governance structures earlier than choosing a platform for yield farming. Additionally, always concentrate on the dangers involved in decentralized finance and make knowledgeable selections based mostly by yourself risk tolerance And monetary targets. Tasks can encourage users to supply liquidity to decentralized exchanges via yield farming, leveraging token utility. Liquidity suppliers stake a pair of tokens in a liquidity pool to earn transaction fees and additional project tokens. This enhances market liquidity as tokens are continuously in use, increasing their utility.

A rise in funds happens from producing extra income than another Yield Farming opportunity as a steady rise in funding value is registered in fund pools. However, the Yield Farming method incorporates quite so much of belongings, all of that are very unstable and don’t demand any linkage. It’s important to understand these dangers and the way every platform attempts to mitigate them before diving in. Welcome to our complete guide on the best yield farming crypto platforms for 2025. In this weblog Digital asset submit, we’ll take a deep dive into the world of yield farming – a revolutionary practice that’s quickly gaining reputation among crypto lovers and traders alike.

How Does Appinventiv Handle Yield Farming Defi Development?

Everybody who is conscious of what a DeFi yield app is, knows the means it works on a high level. Nevertheless, a crucial a part of DeFi yield farming development is getting an excellent grasp of the users’ motion and then creating options that might support the journey. This meteoric rise in interest has pushed numerous entrepreneurs in the direction of DeFi yield farming growth. Beginners ought to familiarize themselves with key Yield Farming terms what’s a hardware wallet corresponding to APY (Annual Share Yield), impermanent loss, and token rewards. It can be advisable to begin out with easier strategies and progress to extra advanced approaches as one positive aspects experience. Moreover, it may be very important stay informed in regards to the newest tendencies and updates within the Yield Farming subject, as the DeFi ecosystem evolves quickly.

DeFi yield farming platform improvement helps projects to design yield farming applications with scheduled reward distributions. This helps in aligning token issuance with specific project milestones, occasions, or intervals of elevated exercise. This strategic approach prevents sudden spikes in token supply and ensures a steady and predictable reward system for individuals. In essence, DeFi yield farming platform improvement acts as one of the catalysts for capital formation, driving TVL progress, and shaping the success and notion of DeFi projects.

Hiring One Of The Best Defi Yield Farming Improvement Firm

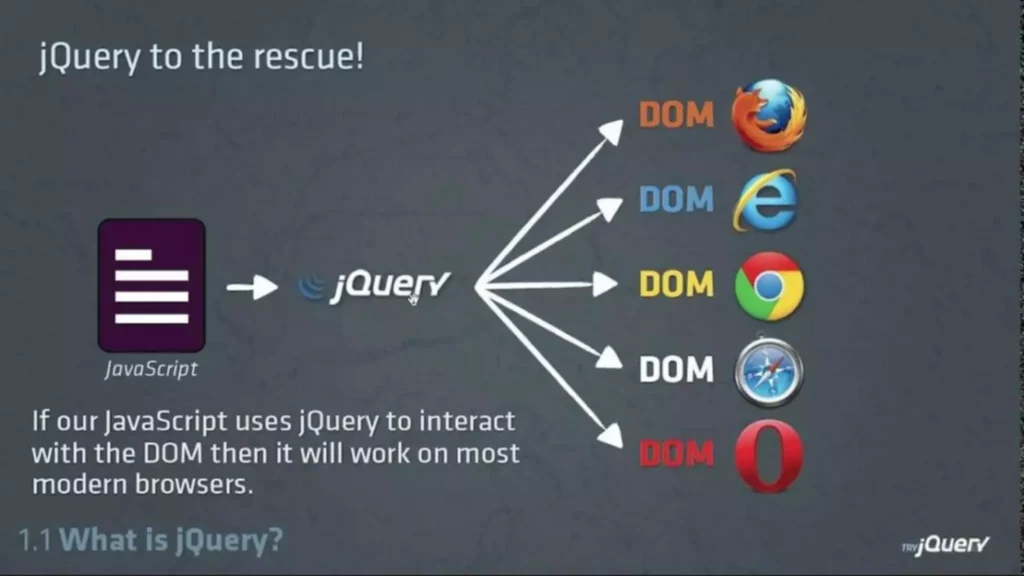

Yield farming mechanisms also can align the pursuits of token holders with the general success of the protocol, enhancing app governance. Liquidity suppliers deposit their cash in liquidity swimming pools, which allow token lending, borrowing, and staking. In most instances, the pools cost a charge, which is subsequently used to incentivize liquidity providers in proportion to their deposits. Yield farming relies on sensible contracts, that are topic to potential vulnerabilities and exploits. Bugs or security vulnerabilities in sensible contracts can end result in financial loss, together with the loss of deposited funds and earned rewards.

Yield Farming is an interesting element of decentralized finance (DeFi) that’s attracting more and more buyers to the world of cryptocurrencies. For beginners, it is important to grasp the elemental steps to effectively embark on this journey. This entails choosing the right platform, understanding Yield Farming strategies, and knowing finest practices to attenuate dangers. Execute extensive testing on the testnet to validate the smart contracts’ performance.

Yield farming offers enticing rewards, but it’s essential to recognize the challenges and risks concerned. Mainnet deployment marks a big milestone within the journey of DeFi yield farming app development, transitioning from testing environments to stay production environments. Writing secure code helps mitigate the chance of vulnerabilities and potential exploits, safeguarding person funds and preserving the integrity of the protocol. Objectives could embrace enhancing liquidity provision and optimizing yield era mechanisms. By articulating particular objectives, yield farming builders can focus their efforts and sources on attaining tangible outcomes. Some notable trends embody the rise of decentralized derivatives platforms and the integration of non-fungible tokens (NFTs) into DeFi ecosystems.

Like any investment, yield farms with larger projected returns typically have greater danger. Providing liquidity reigns as the most well-liked method of yield farming as a result of passiveness and control over risk publicity. Smart contracts are at the core of the functioning of Yield Farming platforms, however they carry risks. Programming errors or security breaches in these contracts may find yourself in substantial losses. Traders should be conscious that even the most respected platforms aren’t immune to vulnerabilities. The growing complexity of Yield Farming methods also heightens the danger of errors in sensible contracts.

Borrowers in flip pay interest on the amount they borrow which is then paid to users. Depositors provide liquidity to the Aaave protocol which offers secure borrow charges and depositors obtain a tokens which symbolize the worth of their deposited amount. Aaave also allows the flash loans, loans borrowed and repaid in the identical transaction. Curve is the decentralized DeFi protocol for secure assets with prices that aren’t alleged to be largely different. Utilizing the platform’s AMM, Curve Finance permits customers to change these secure belongings even when the opposite a half of the commerce is unavailable.